Definition of Accounting

Accounting is the process of recording, summarizing, analyzing, and reporting financial transactions of a business.

Accounting is a systematic recording day to day business transaction is called as accounting. Accounting is the process of identifying, recording, classifying and reporting information on financial transactions in a systematic manner for the purpose of providing financial information for decision making. It helps businesses track their income, expenses, assets, and liabilities to ensure accurate financial management.

- How much profit or loss has the business made?

- What are the total expenses and income?

- What are the assets and liabilities of the business?

Example:- Imagine a small business selling mobile phones. The owner buys phones from a wholesaler and sells them to customers. Every sale, purchase, expense, and payment needs to be recorded systematically to calculate profit or loss. Accounting helps in keeping track of these transactions properly.

- Identifying:- In accounting, the process begins with identifying financial transactions. This involves recognizing and gathering information about any economic events or activities that have a financial impact on an organization.

- Recording:- Once financial transactions are identified, they are recorded in a systematic and organized manner. This typically involves entering data into accounting journals or software.

- Classifying:- After recording, transactions are classified or categorized into various accounts. This step involves allocating each transaction to the appropriate account, such as revenue, expenses, assets, liabilities, and equity.

- Reporting:- Accounting goes beyond just recording transactions; it involves preparing and presenting financial reports

Types of Accounts

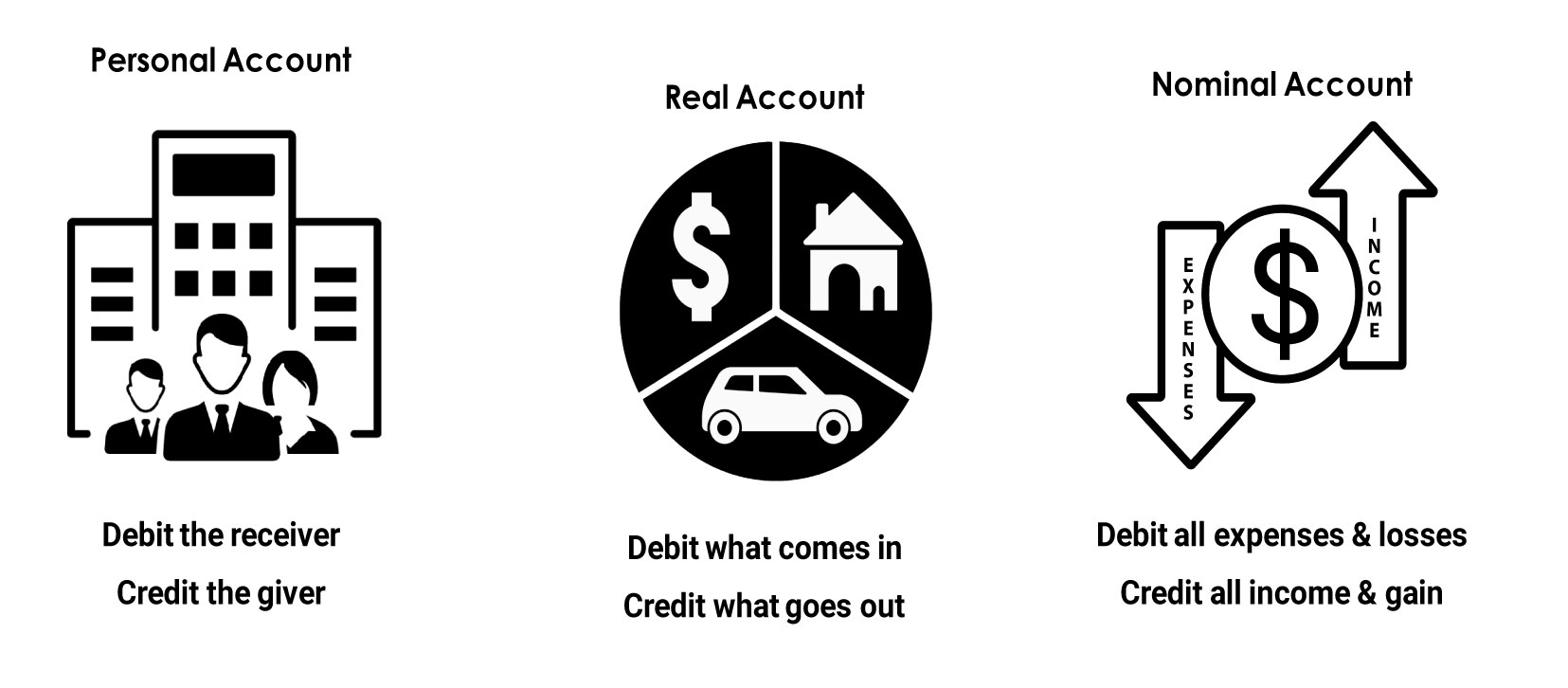

There are basically three types of Accounts maintained for transactions

- Personal Account

- Real Account

- Nominal Account

1. Personal Account:- Any individual person or any firms or any company or a bank is considered in a Personal account.

For example:-

- Rajesh Singh

- Munna Enterprise

- Wipro Pvt Ltd

- PNB Bank

- Capital etc.

Rules -:

- Debit the receiver

- Credit the giver

Debit the receiver, credit the giver: When a business receives something, such as cash or goods, it is recorded as a debit in the accounting system. When a business gives something, such as cash or goods, it is recorded as a credit in the accounting system.

2. Real Account: Account of any physical things. The cash account or goods account are examples of Real account.

For example:-

- Cash

- Land

- Building

- Furniture

- Computer etc.

Rules :-

- Debit what comes in

- Credit what goes out

Debit what comes in, credit what goes out: When there is an inflow of assets or an increase in liabilities, it is recorded as a debit in the accounting system. When there is an outflow of assets or a decrease in liabilities, it is recorded as a credit in the accounting system.

3. Nominal Account: Account of any invisible things that means that things are in terms of cash are examples of Nominal account.

For example:-

- Discount

- Commission

- Salary

- wages

- Freight etc.

Rules :-

- Debit expenses and losses

- Credit incomes and gains

Debit expenses and losses, credit incomes and gains: This rule states that expenses and losses are recorded as debits in the accounting system, while incomes and gains are recorded as credits.